Avoid the hassle of e-filing your 1099 and 1095 forms in a rush before March 31, 2023!

Request an Extension Today.

How to file Form 15397 with ExpressExtension?

Enter Form Details

Choose the form type for which you need an extension and enter the required data.

Review the Form

Once completed, review the draft form and make sure the information entered

is correct.

Transmit to the IRS

ExpressExtension will fax the form to the IRS on your behalf.

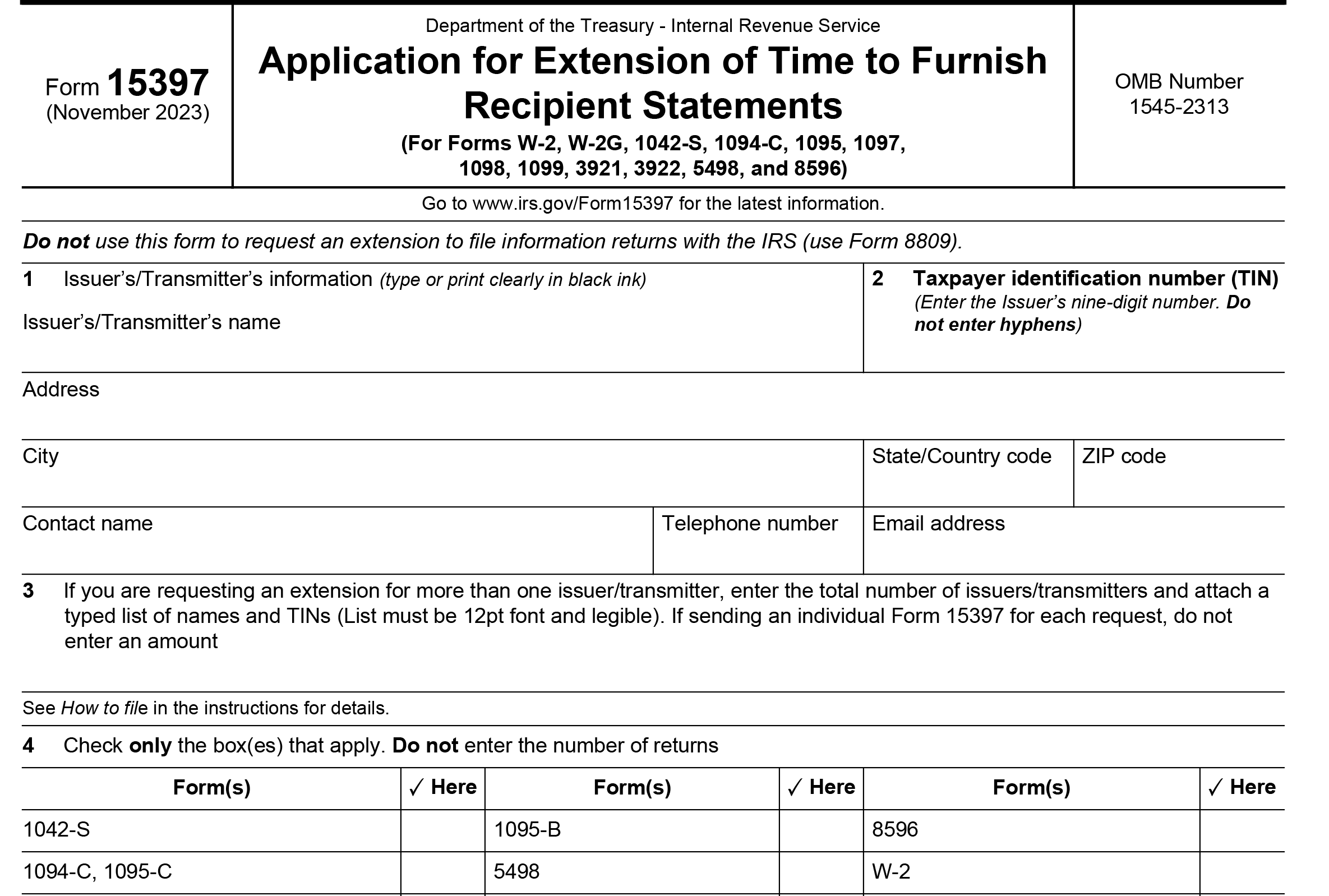

What Information is Required to File Form 15397 Online?

- Tax Payer Details such as Name, TIN, and Address

- Type of Forms for which the extension is filed

Note: Make sure your information matches what the IRS has on record. You can verify your information with the IRS by calling 1-800-829-4933.

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Frequently Asked Questions about Form 15397

What is Form 15397?

Form 15397 is used by businesses to request an extension of up to 30 days to provide copies of your 1099, W2, ACA, 5498, and other information returns to recipients.

It is important to note that Form 15397 only extends the deadline for distributing the recipient copies and not the IRS filing deadline.

If you need an extension to file your 1099, W-2, 1095 and other information return to the IRS, you must file Form 8809.

What are the forms whose deadlines I can extend using Form 15397?

The deadline to distribute the recipient copies of the following forms can be extended using Form 15397:

| List of Forms | ||

|---|---|---|

| 1097, 1098, 1099, 3921, 3922, W-2G | 5498 | W-2 |

| 1099-NEC | 5498-ESA | 1042-S |

| 1099-QA | 5498-QA | 1094-C, 1095-C |

| 8596 | 5498-SA | 1095-B |

When is the due date to file Form 15397?

Form 15397 must be filed by the deadline for submitting the original recipient's copy of the applicable Information Statement. However, Form 15397 cannot be filed before January 1st.

For example, if you need to extend the deadline for recipient copies of your 1099-NEC, you must file Form 15937 by January 31.

When Can I file Form 15397?

According to IRS instructions, Extension Form 15397 can only be filed in the following situations:

- The applicant has experienced a catastrophic event in a federally declared disaster area, and as a result, the applicant is unable to resume operations, or the required records are no longer available.

- If a fire, accident, or natural disaster affects the declarant's operations,

- If the applicant's activities are affected by death, serious illness, or the unavoidable absence of the person responsible for filing the information declaration,

- The applicant was in its first year of business.

- The sender did not receive payment data for the recipient in a timely manner. Examples: Schedule K-1, Form 1042-S, or sick pay statement under Section 31.6051-3(a)(1). This makes it impossible to prepare accurate information for return. The applicant was in its first year of business.

Where do I send Form 15397?

You can fill out and fax the form to:

IAttn: Extension of Time Coordinator

Fax: 877-477-0572 (International: 304-579-4105)