Avoid the hassle of e-filing your 1099 and 1095 forms in a rush before March 31, 2023!

Request an Extension Today.

How to file Information Tax Extension Form 8809 Online

for the 2024 tax year?

Enter Tax Payer Details

Choose the Information Tax Forms to Extend

Review your Form

Transmit your Form 8809

to the IRS

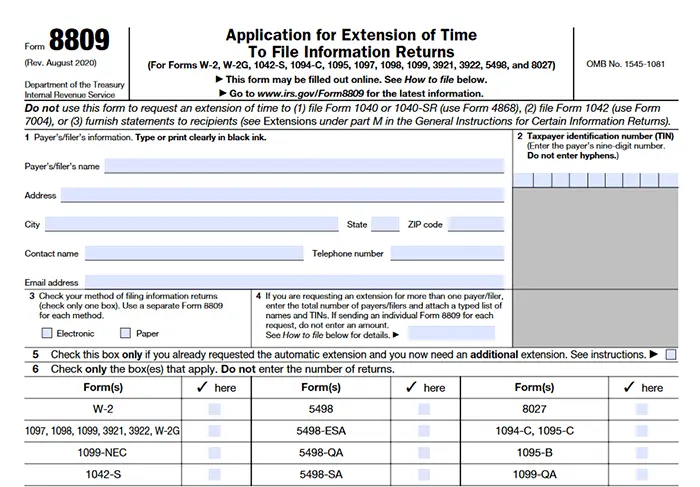

What Information is Required to file 2024 Information Tax Extension Form 8809 Online?

- Tax Payer Details such as Name, TIN,

and Address - Type of Forms for which the extension

is filed

Note: Make sure your information matches what the IRS has on record. You can verify your information with the IRS by calling 1-800-829-4933.

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Frequently asked questions about Form 8809 Extension

What is IRS Form 8809?

The Information Return Extension Form 8809 is used by businesses that need more time to file their 1099s, ACA, or information forms with the IRS. Upon filing the IRS Form 8809, you can get a 30-day automatic extension to file your information tax returns

Note: The extension is not automatic for W2 and 1099-NEC forms.

How to extend the filing deadline for W2 and 1099-NEC forms?

The extension for W-2 and 1099-NEC is no longer automatic. But still, the businesses can file Form 8809 to extend the deadline for W2 and 1099-NEC forms under the following circumstances.

- The filer suffered from a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or made necessary records unavailable.

- Fire, casualty, or natural disaster affected the operation of the filer.

- Death, serious illness, or unavoidable absence of the individual responsible for filing the information returns affected the operation of the filer.

- The filer was in the first year of establishment.

Note: Those who need an extension of time to file 1099-NEC, W-2, 1099-QA, and 5498-QA Forms must mail Form 8809 to the following address.

Internal Revenue Service Center

Ogden, UT 84201-0209

When is the deadline to file Extension Form 8809?

The deadline to file the extension Form 8809 is based on the form for which the extension is being requested.

| Form | Paper Filing Deadline | E-filing Deadline |

|---|---|---|

| W-2, and 1099-NEC | January 31, 2025 | January 31, 2025 |

| 1094 and 1095 | February 28, 2025 | March 31, 2025 |

| 1099 Forms | February 28, 2025 | March 31, 2025 |

| W-2G, 1097, 1098, 3921, 3922, and 8027 | February 28, 2025 | March 31, 2025 |

| 1042-S | March 17, 2025 | March 17, 2025 |

| 5498 | June 2, 2025 | June 2, 2025 |

Looking to file W2, 1099, and ACA Forms?

Get Started with TaxBandits, our sister product, and complete your filing without any hassle and for the lowest price available

in the market.

What are the Late Filing Penalties for Form 8809?

If you file information returns late, and you have not applied for an extension by filing IRS Form 8809, you may be subject to the following late filing penalties:

- $50/return for information returns filed within 30 days after the deadline with a maximum penalty of $588,500 (for large businesses) and $206,000 (for small businesses).

- $110/return for information returns that are delayed more than 31 days but not later than August 1 with a maximum penalty of $1,766,000 (for large businesses) or $588,500 (for small businesses).

- $290/return for information returns filed after August 1 with a maximum penalty of $3,532,500 (for large businesses) or $1,177,500 (for small businesses).

Note: Businesses with average annual gross receipts of more than $5M for the recent 3 tax years are considered large businesses, whereas Businesses with gross receipts less than or equal to $5M are considered small businesses.

Does Form 8809 extend the deadline to provide copies to recipients?

No! Form 8809 only extends the filing deadline. To request an extension for recipient copy distribution, you must complete Form 15397 and send it to the IRS. For more information about Form 15397, click here

Ready to File Information Return Extension

Form 8809 Online?

Get Started with ExpressExtension & file your form in minutes.