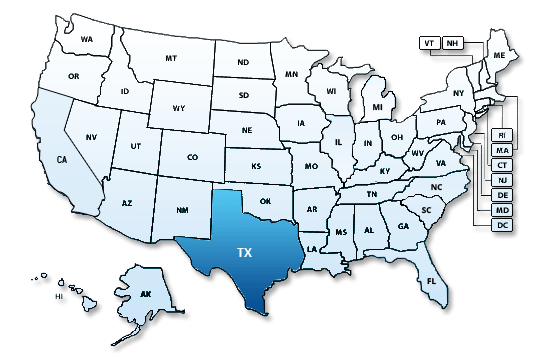

Texas State Tax Extensions: Business, Personal, Information and Nonprofit Tax Returns

Texas does not have state income tax. So extension of time for personal and business tax extension is not required.

If you received a confirmation email from ExpressExtension that your federal tax extension (Form 7004) was approved, there's nothing more you need to do.

For additional information and other taxes that might be due (including annual franchise taxes), please visit the State of Texas State Comptroller website. http://www.window.state.tx.us/taxes/

If you already received an approval notification from ExpressExtension, and you don't need to make a tax payment, then you're all done.

For more information, visit the State of Texas State Comptroller website. http://www.window.state.tx.us/taxes/

We support only federal tax extension forms.