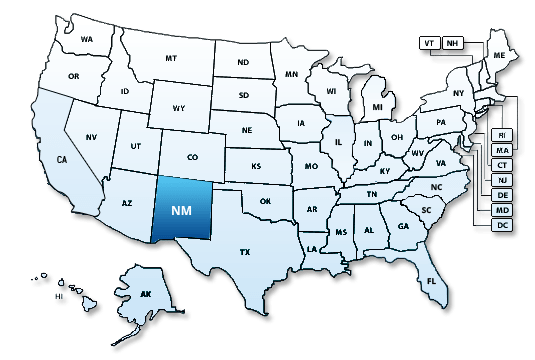

New Mexico Tax Extensions: Business, Personal, Information and Nonprofit Tax Returns

If a federal automatic extension has been obtained for the period of this extension,

you do not need to submit Form RPD-41096, Application for Extension of Time to File.

To qualify for an extension, this form must be submitted on or before the due date

of the return or the extended due date of the return.

RPD-41096 is the form used for both Personal and Business tax extensions.

NOTE: By obtaining an extension of time to file your return, penalty

for failure to file and pay is waived through the extension period, provided you

file the return and pay the tax shown on the return by the extended due date. Interest

accrues even if the taxpayer obtains an extension of time to file and pay the return.

Interest is assessed daily at the quarterly rate established for individuals by

the U.S. Internal Revenue Code on the amount of tax due. Annual and daily interest

rates for each quarter are posted on the Department web site.

Form RPD-41096, Application for Extension of Time to File

By obtaining an extension of time to file your return, penalty for failure to file and pay is waived through the extension period, provided you file the return and pay the tax shown on the return by the extended due date. However, interest accrues even if the taxpayer obtains an extension of time to file and pay the return. To avoid interest, make a payment of the tax to be due by the original return due date. Interest is assessed daily at the quarterly rate established for individuals by the U.S. Internal Revenue Code on the amount of tax due. Annual and daily interest rates for each quarter are posted on the Department web site.When to File?

An application for extension of time to file must be postmarked on or before the due date for filing the return or the extended due date of the return if a federal automatic extension or a New Mexico extension has been obtained. If a federal automatic extension is obtained, and you file and pay the return by the extended due date allowed by the IRS, Form RPD-41096, does not need to be submitted. New Mexico recognizes and accepts an Internal Revenue Service automatic extension of time to file.How and Where to File?

Complete this form and send it to:Taxation and Revenue Department,

P.O. Box 630,

Santa Fe,

NM 87504-0630.

If you are including an extension payment for a personal income tax return, corporate income and franchise tax return, S corporate income and franchise tax return or fiduciary income tax return with the extension, also attach the applicable extension payment voucher (Forms PIT-EXT, CIT-EXT, S-Corp-EXT or FID-EXT) and submit the forms to the address on the payment voucher. The address varies depending upon the tax program.

Reasons for Extensions:

The Taxation and Revenue Department will grant a reasonable extension of time for filing a return if the taxpayer files a timely application which establishes that he is unable to file the return by the due date because of circumstances beyond his control. Inability to pay the tax due is not sufficient reason for issuance of an extension. Also, extensions will not be granted to tax practitioners because of excessive work load.Period for Extensions:

Generally, a timely initial application for extension of time to file will be automatically granted for a period not to exceed 60 days. Longer periods of time will not be granted unless sufficient need for the extended period is clearly shown. Form RPD-41096 may also be used to request an additional extension. When used for that purpose, a copy of the previous state or federal automatic extension should be attached to the application.Why should I use Express Extension?

ExpressExtension has an experienced and competent team to meet all your individual and business tax solutions.We provide a complete and easy solution to all your tax needs.We support only federal tax extension forms.