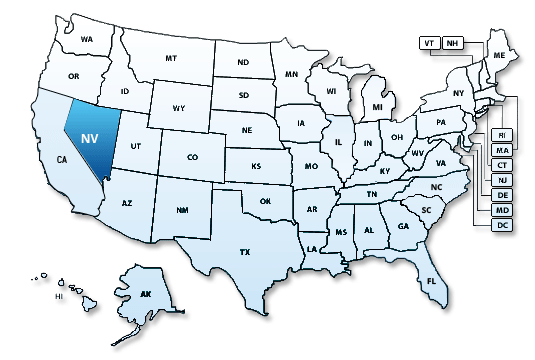

Nevada Tax Extensions: Business, Personal, Information and Nonprofit Tax Returns

Nevada does not have state income tax. So extension of time for personal and business tax extension is not required.

The State of Nevada does not have a state income tax. Therefore, there is no state

of Nevada business income tax extension. If you received a confirmation email from

ExpressExtension that your federal

tax extension was approved, there's nothing more you need to do.

The Nevada Department of Taxation is bound by statute to keep information confidential

regarding a taxpayer's account. In regard to a Sales/Use Tax Permit, the only information

available to the general public is the information on the actual permit. More specifically,

the Permit Number, Owner, Business Name, Business Location and Date of Issue. All

other information contained in Department records is confidential and disclosure

of that information is prohibited without a Governor's approval pursuant to NRS

372.750(3) or a signed authorization from the taxpayer.

The State of Nevada does not have a state income tax. That means there's no personal income tax extension! If you received a confirmation email from ExpressExtension that your federal Tax Extension form 4868 was approved, you're done!

We support only federal tax extension forms.