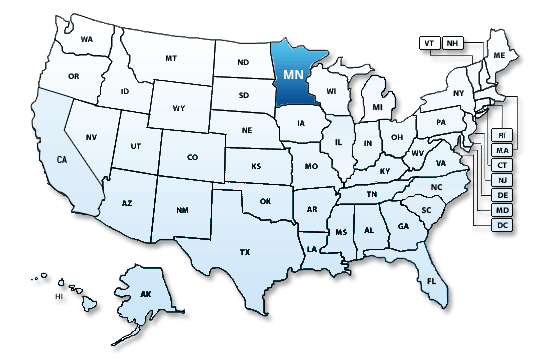

Minnesota State Tax Extensions: Business, Personal, Information and Nonprofit Tax Returns

The state of Minnesota automatically grants you an extension of 6 months automatically.

However,any tax due to the tax must be filed by using Form M13

All corporations are granted an automatic seven-month extension to file Form M4.

You are not required to submit a form to Minnesota to receive the seven-month filing

extension.

However, if the Internal Revenue Service (IRS) grants an extension of time to file

your federal return that is longer than the Minnesota automatic seven-month extension,

your state filing due date is extended to the federal due date.

All corporations are granted an automatic seven-month extension to file Form M4. You are not required to submit a form to Minnesota to receive the seven-month filing extension.

However, if the Internal Revenue Service (IRS) grants an extension of time to file your federal return that is longer than the Minnesota automatic seven-month extension, your state filing due date is extended to the federal due date.

Your tax is due by the regular due date, even if you are filing under an extension. Any tax not paid by the regular due date is subject to penalties and interest (see lines 16 and 17 on page 5).

If you're filing after the regular due date, you can avoid penalties and interest by making an extension payment by the regular due date. See Payment Options on this page. If you're paying by check, send a completed Form PV81 along with your payment.

An S corporation must make quarterly estimated tax payments if the sum of its estimated S corporation taxes, minimum fee, nonresident withholding and composite income tax for all nonresident shareholders electing to participate in composite income tax, less any credits, is $500 or more. Payments are due by the 15th day of the fourth, sixth and ninth months of the tax year and the first month following the end of the tax year.

Check this link for more detail for S Corporation Payment: http://www.revenue.state.mn.us/Forms_and_Instructions/pv81.pdf for more details.

If the due date lands on a weekend or legal holiday, payments electronically made or postmarked the next business day are considered timely.If estimated tax is required for the S corporation taxes/minimum fee, composite income tax, and/or nonresident withholding, include all in the same quarterly payments.

To make an estimated payment, see Payment Options above. If you're paying by check, send a completed Form M72 with your payment.

Why should I use Express Extension?

ExpressExtension has an experienced and competent team to meet all your individual and business tax solutions. We provide a complete and easy solution to all your tax needs.Your tax is due April 15, 2025, even if you are filing Form M1 after the due date. Use these instructions to determine the tax you must pay by the due date to avoid penalties and interest.

Do not use this form if you are filing Form M1 on or before April 15, 2025, and paying your tax after the due date.

All tax must be paid by April 15, 2025, even if you have an extension to file your federal return. There are no extensions to pay your Minnesota individual income tax. If you will be filing Form M1 after the due date, estimate the total tax you owe and pay that amount by April 15, 2025. You can pay electronically, by credit card or by check. Your payment will be credited to your 2024 estimated tax account. When you file your Minnesota return, include your extension payment on line 24 of your 2024 Form M1.

If you pay after April 15, 2025, your payment will be considered delinquent and will be applied to the amount you owe on your return. The payment will not be credited to your 2024 estimated tax account.

If you pay at least 90 percent of your total tax by April 15, 2025, and file your Form M1 with payment of the remaining tax due no later than October 15, 2025, you will not be charged a late payment penalty. If you fail to pay your tax as required, a 4 percent late payment penalty will be assessed on the tax not paid by the original due date. Interest will be assessed on any unpaid tax and penalties from the original due date until paid in full.

I filed an extension for my federal tax return. How do I file an extension for my state return?

Each state has its own requirements, you must file the correct state-specific form to get an extension. ExpressExtension allows you to file extensions for Federal Only.If I owe tax on my Minnesota return this year, but if I'm not ready to file by April 15. What should I do?

Estimate the amount you'll owe and pay it by April 15, 2021, or you'll be charged a late-payment penalty and interest. You can pay electronically (see Electronic Payment Options for Individuals), or pay by check with Form M13, Income Tax Extension Payment voucher.Pay by credit or debit card (fees apply)

- Go to payMNtax.com; or

- Call 1-855-9-IPAY-MN.

You will be charged a fee to use this service, which goes directly to Value Payment Systems (a national company that partners with federal, state and local governments to provide credit/debit card payment services).

The Department of Revenue does not have any financial agreement with Value Payment Systems and does not receive any of its fees.

Pay by check

Complete the voucher and mail it with your check to the address shown on the voucher. All information is required. Your check authorizes us to make a one time electronic fund transfer from your account. You will not receive your cancelled check. Make check payable to Minnesota Revenue and mail to:Minnesota Revenue,

P.O. Box 64058,

St. Paul,

MN 55164-0058

Why should I use ExpressExtension?

ExpressExtension has an experienced and competent team to meet all your individual and business tax solutions. We provide a complete and easy solution to all your tax needs.We support only federal tax extension forms.