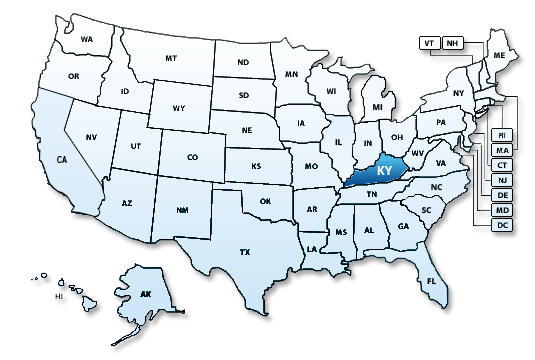

Kentucky State Tax Extensions: Business, Personal, Information and Nonprofit Tax Returns

On getting Federal extension the extension for Kentucky is also granted. You must attach a copy of the application for automatic

federal extension to the Kentucky return. You can also avail the extension by submitting in writing to the Department

of Revenue,Kentucky on or before the due date of the return.You can use Form 40A102 to apply for

extension along with payment.

An extension of time to file a corporation or limited liability pass-through entity income and LLET return may be obtained by either

making a speciï¬c request to the Department of Revenue or attaching a copy of the federal extension to the return when filed.

However, if you want to make payment along with your business extension then you can file Form 41A720SL to achieve the same. Please

note that the copy of the federal extension (Form 7004) submitted AFTER the return is filed does not constitute a valid extension,

and late filing penalties will be assessed.

In accordance with the provisions of KRS 131.081(11), KRS 131.170, KRS 141.170, and Regulation 103 KAR 15:050, an extension of time to file a Kentucky corporation income tax and LLET return or a limited liability pass-through entity income and LLET return may be obtained by either:

- Requesting an extension pursuant to KRS 141.170 before the date prescribed by KRS 141.160 for filing the return, i.e., the 15th day of the fourth month following the close of the taxable year. Use Kentucky Form 41A720SL

- Submitting with your return a copy of federal Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

Federal Extension

A corporation or limited liability pass-through entity granted an extension of time forfiling a federal income tax return will be granted the same extension of time for filing a Kentucky income and LLET return for the same taxable year provided a copy of the federal Form 7004 is attached to the Kentucky income and LLET return when it is filed.A copy of the federal Form 7004 shall not be mailed to the Department of Revenue before filing the return. If submitting payment with extension, use Kentucky Form 41A720SL

Kentucky Extension

An extension of time to file a corporation or limited liability pass-through entity income and LLET return may be obtained by either making a speciï¬c request to the Department of Revenue or attaching a copy of the federal extension to the return when filed. A copy of the federal extension (Form 7004) submitted after the return is filed does not constitute a valid extension, and late filing penalties will be assessed. If a corporation or limited liability pass-through entity is making a payment with its extension, Kentucky Form 41A720SL must be used.Why should I use ExpressExtension?

ExpressExtension has an experienced and competent team to meet all your individual and business tax solutions.We provide a complete and easy solution to all your tax needs.Taxpayers who are unable to file a return by April 15, 2021 may request an extension. The request for the extension must be submitted in writing to the Department of Revenue on or before the due date of the return. The request must state a reasonable cause for the inability to file. Inability to pay is not an acceptable reason. Acceptable reasons include, but are not limited to, destruction of records by fire or flood and serious illness of the taxpayer. Extensions are limited to six months. A copy of the Kentucky extension request must be attached to the return.

Individuals who receive a federal extension are not required to request a separate Kentucky extension. They can meet the requirements by attaching a copy of the application for automatic federal extension to the Kentucky return.

How to make Payment If I owe anything?

Kentucky Extension:Form 40A102 - Application for Extension of Time to File Individual, General Partnership, and Fiduciary Income Tax Returns for Kentucky is available here for download.

Complete Section II, Kentucky Extension Payment Voucher, of the Application for Extension of Time to File, Form 40A102, and send with payment. Write "KY Income Tax—2024" and your Social Security number(s) on the face of the check.

Federal Automatic Extension: Make a copy of the lower portion of the federal Application for Automatic Extension, Form 4868, and send with payment. Write "KY Income Tax — 2024" and your Social Security number(s) on the face of the check.

I want to know about Interests and Penalties

Interest and Penalties :Interest at the "tax interest rate" applies to any income tax paid after the original due date of the return. If the amount of tax paid by the original due date is less than 75 percent of the tax due, a late payment penalty may be assessed (minimum penalty is $10)Mail to:

Kentucky Department of Revenue,

P.O. Box 1190,

Frankfort,

KY 40602-1190.

Why should I use Express Extension?

ExpressExtension has an experienced and competent team to meet all your individual and business tax solutions. We provide a complete and easy solution to all your tax needs.We support only federal tax extension forms.