Avoid the hassle of e-filing your 1099 and 1095 forms in a rush before March 31, 2023!

Request an Extension Today.

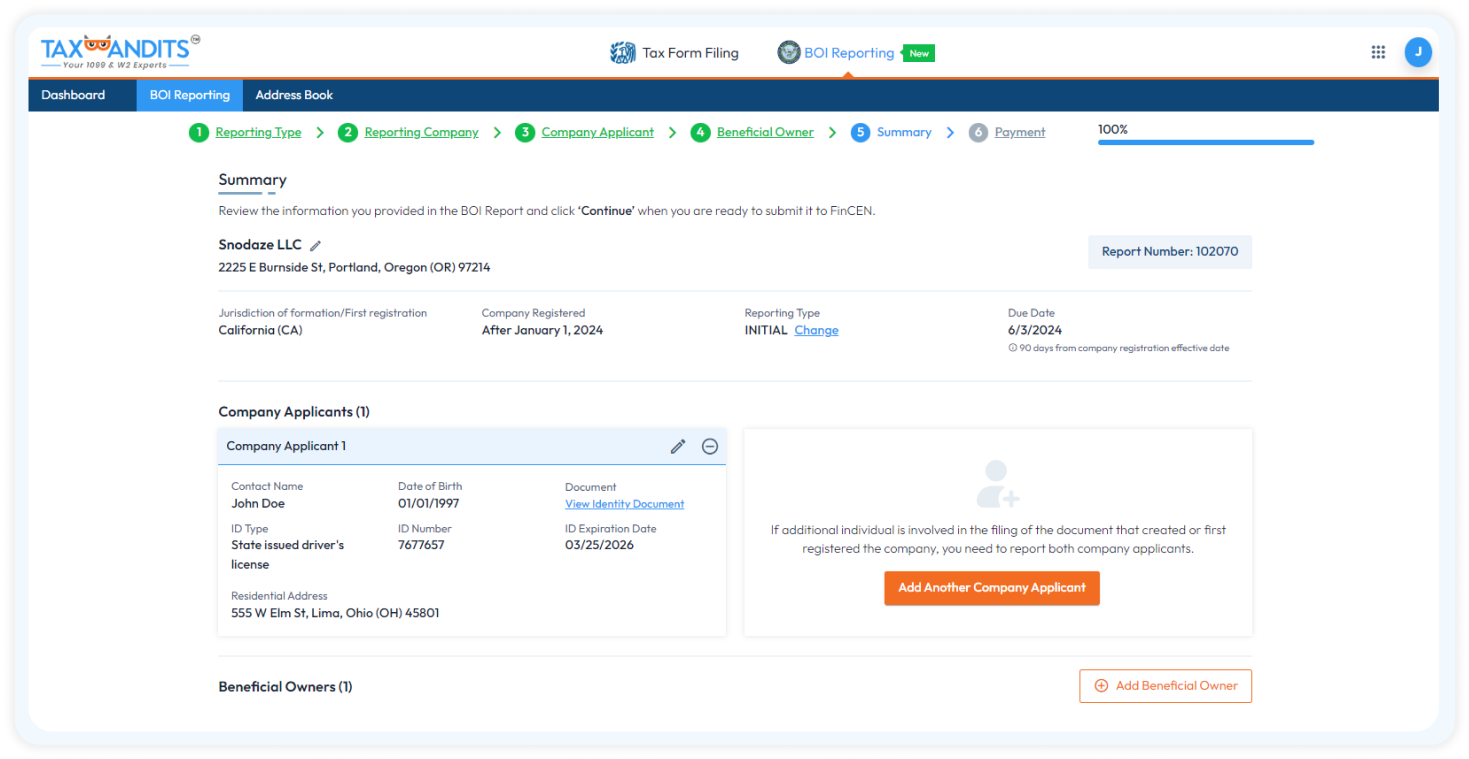

How to File BOI Report Online for 2024?

Follow these simple steps to complete your BOI reporting:

Enter BOI Report Information

Add Company Applicant & Beneficial Owner Information

Review & Submit to FinCEN

Start filing your BOI reports online. It’ll take only a few minutes.

File BOI Report Now

Benefits of Filing BOI Online

For Small Businesses, We support filing of BOI reports with FinCEN. Here are the best

benefits to simplify your BOI filing online.

Easy & Secure Filing

File Your BOI Report easily and securely. Access your BOI Report anytime.

Support Initial, Correction & updates

We Support filing of Initial Report, Correct & update the prior report.

Free BOI Corrections

You can submit a corrected or updated report for free within 7 days from the date the initial BOIR was accepted by FinCEN.

Instant Status Updates

We will notify your updates on BOI Report via email or you can track the status from the dashboard.

Visit https://www.taxbandits.com/efile-boi-report-online/ to learn more about the benefits

offered to simplify your BOI Filing.

Get Started Now

What information is Needed to File BOI Report Online?

The following information is needed to file your BOI Report :

- Reporting type: Initial, Update, Correct or Newly Exempt Entity

- Reporting Company Details: Name, EIN, Address, etc.

- Company Applicant(s) Details: Name, Date of Birth, Address and Identity Proof

- Beneficial Owner Details: Name, Date of Birth, Address and Identity Proof

When is the Deadline to File BOI Report?

For a business formed or registered on or after January 1, 2024, the due date to file the initial BOI report is within 90 days of the firm's registration date.

For businesses created or registered before January 1, 2024, the due date for filing the initial BOI report is January 1, 2025.

Frequently Asked Questions on BOI Report Filing

Who is required to File BOI?

A company is required to file a BOI report if it meets FinCEN’s beneficial owner reporting rule’s definition of a “reporting company” and does not qualify for an exemption.

How can you know whether your business is a reporting company? Reporting companies are designated as domestic or foreign. The following are the criteria for domestic reporting or foreign companies:

- Domestic reporting company— A corporation, LLC, or any other entity created by filing a document with a secretary of state or similar office under the laws of the State or Indian Tribe.

- Foreign reporting company— A corporation, LLC, or any other entity formed under the law of a foreign country by filing a document with the secretary of state or a similar office registered to do business in any U.S. State or Tribal Jurisdiction.

Who is a beneficial owner of a reporting company?

A beneficial owner of a reporting company (or any entity required to submit a BOI report) is defined as any individual who directly or indirectly:

- exercises substantial control over a reporting company (or)

- owns or controls at least 25% of the firm’s ownership interests

A person can be a beneficial owner by possessing substantial control, ownership interests, or both. The Reporting firm can have multiple beneficial owners. However, they are not required to declare the cause of an individual's beneficial ownership (i.e., substantial control or ownership interests).

Who is a company applicant for a reporting company?

Starting in January 2024, companies must file a Beneficial Ownership Information Report, which asks for information about the entity’s beneficial owners and company applicants. Your company applicant is the person or business entity that files the document forming or registering your company with the state, tribe, or other US jurisdiction.

Are there any penalties associated with BOI Reports?

According to the FinCEN rule outlined in the Corporate Transparency Act, anybody who fails to comply with the BOI reporting requirements will face civil penalties of up to $500 per day. Furthermore, criminal penalties include up to two years in incarceration(prison) and a $10,000 fine.