Guaranteed Approval: We Ensure IRS Approval – File 7004 with Confidence!

With Express Guarantee, filing your extension is stress-free—our system and support team help ensure accuracy and IRS approval.

Internal Audit Check

Our system automatically validates your return for common errors before transmission, helping prevent IRS rejections.

AI Assistance & World-Class Support

Our AI chatbot, along with our expert team, guides you through the filing process to ensure accuracy.

Free Retransmission

If your extension is rejected due to errors, you can correct and resubmit it at no extra cost.

Guaranteed Approval or Money Back

If your Form 7004 is rejected as a duplicate, we’ll issue a full refund—no hassle, no waiting.

Simplify Form 7004 Filing with ExpressExtension

Explore our robust features that make extension filing smooth and hassle-free!

Quick and Easy Filing

E-file your 7004 extension in three simple steps—designed for accurate and hassle-free filing.

File from Any Device

E-file your extension using any device, offering a flexible and convenient filing experience without any restrictions.

Copy Return

Your extension form is prefilled with data from your prior year filings. Just review and submit to complete your filing in no time.

Bulk Upload

Save time and maximize efficiency by using our bulk upload option to import your data seamlessly.

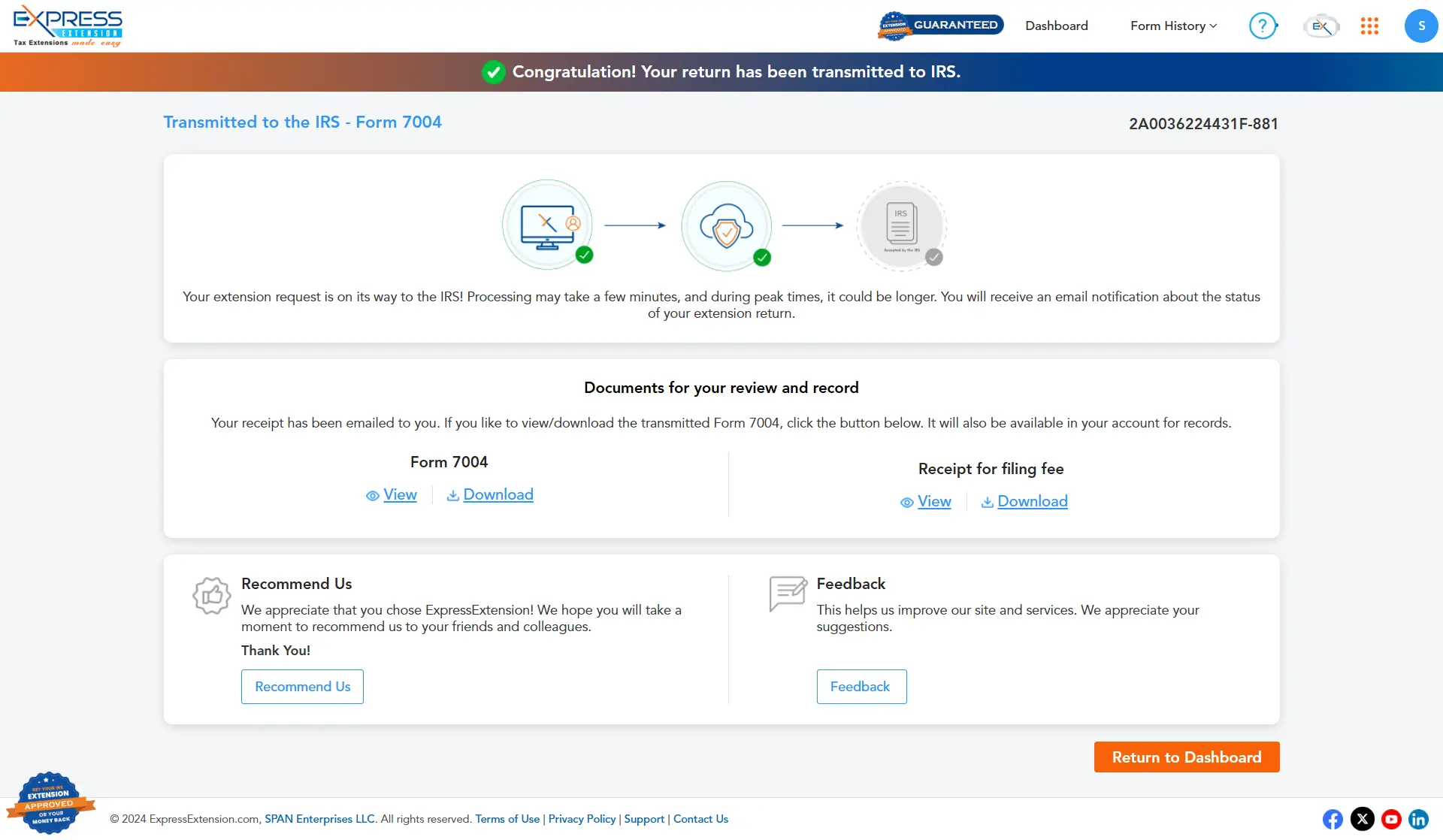

Real-Time Status Updates

Receive instant status updates from the IRS to track your extension status and stay informed and up-to-date.

Guaranteed Approval or Moneyback

Form 7004 acceptance guaranteed! If your form is rejected for duplicate filings, get your money back instantly.

Free Re-Transmission

If the IRS rejects your return due to errors, easily correct them and resubmit at no cost.

World-Class Support

Our expert support team is ready to help you via email, phone, and live chat throughout the filing process.

File Form 7004 online now and get an automatic extension of up to 6 months!

Exclusive PRO Features Designed for Tax Professionals

Enhance your tax filing process and optimize workflows with our robust tools tailored for tax professionals.

Manage all your Clients

Securely manage and file extensions for all clients from one convenient place.

Bulk Filing

Effortlessly upload your data in bulk and save time with our easy-to-use bulk upload templates. Learn More

Volume Based Pricing

Take advantage of our volume-based pricing. The more you file, the more you save!

Prepaid Credits

Save time and increase efficiency by purchasing pre-paid credits upfront while bulk filing.

Simplify your Form 7004 Filing with our PRO Features

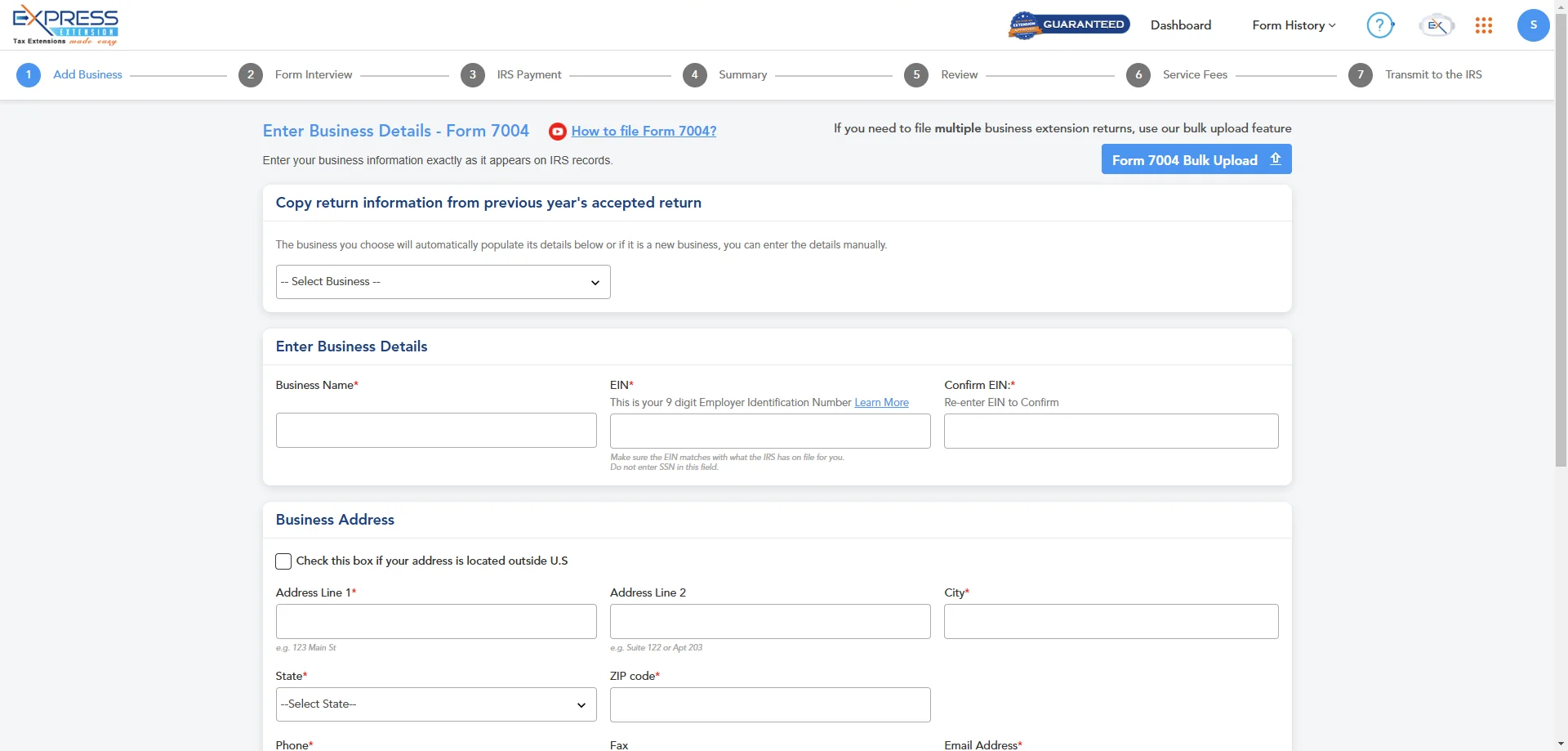

Key Information Required for Filing Form 7004

Basic Business Information

Provide the Name, EIN, and Address of the business you’re

filing for.

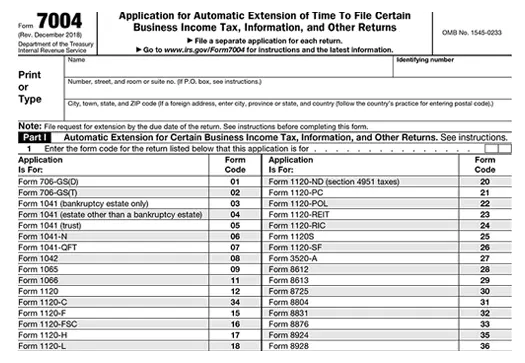

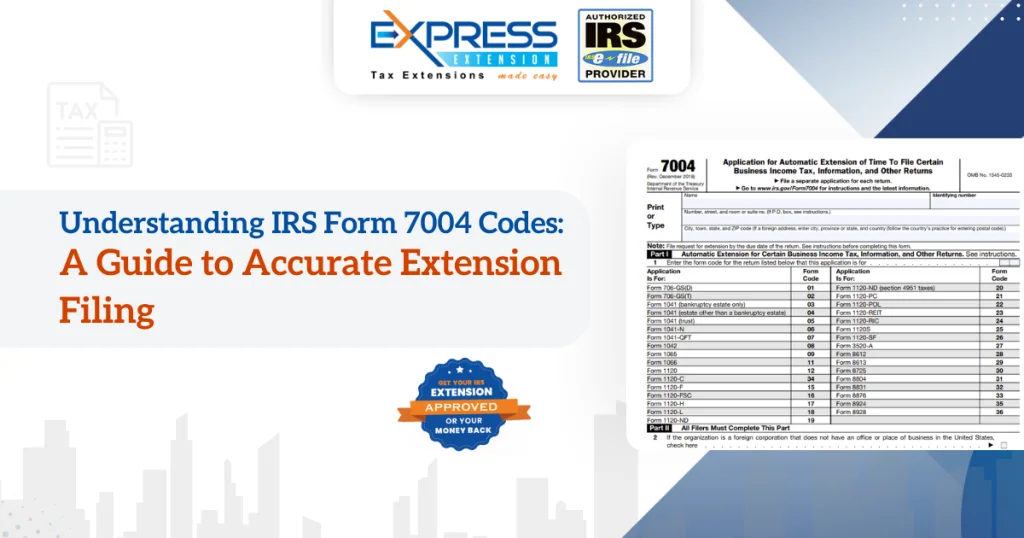

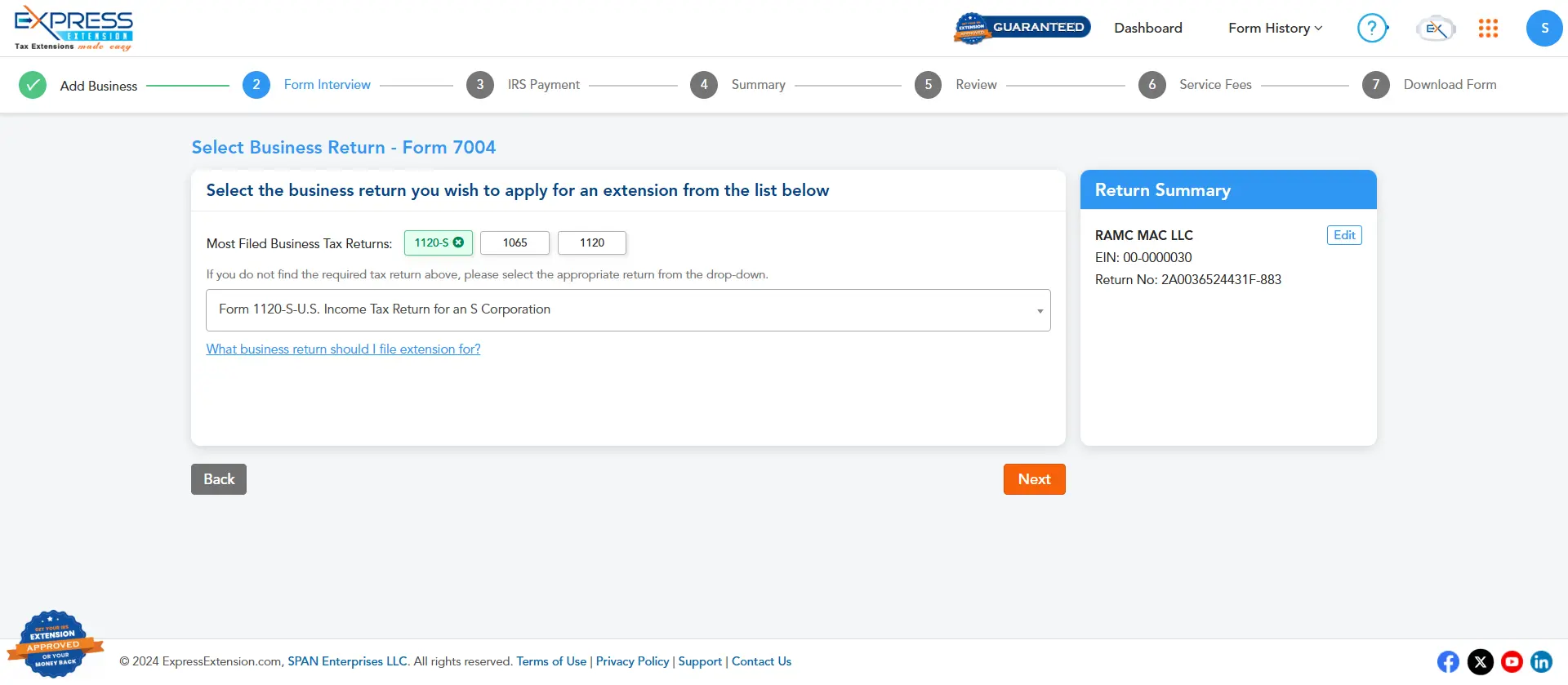

Business Tax Return Type

Choose the business return you need an extension for (e.g., 1120, 1120-S, 1065, 1041).

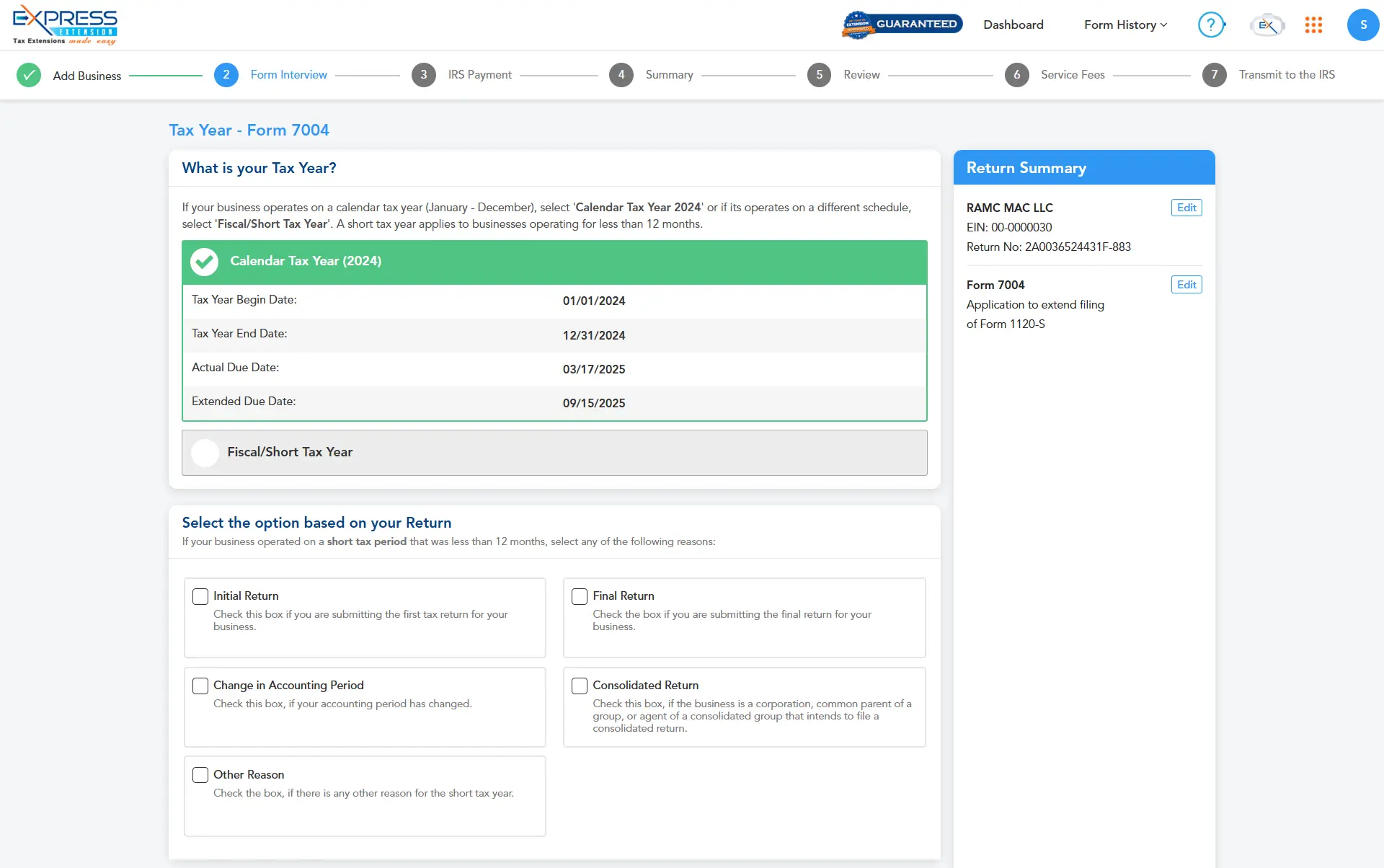

Tax Due Details

Specify the tax period followed by your business and enter any estimated tax dues, if applicable.

Have all the information ready to e-file 7004?

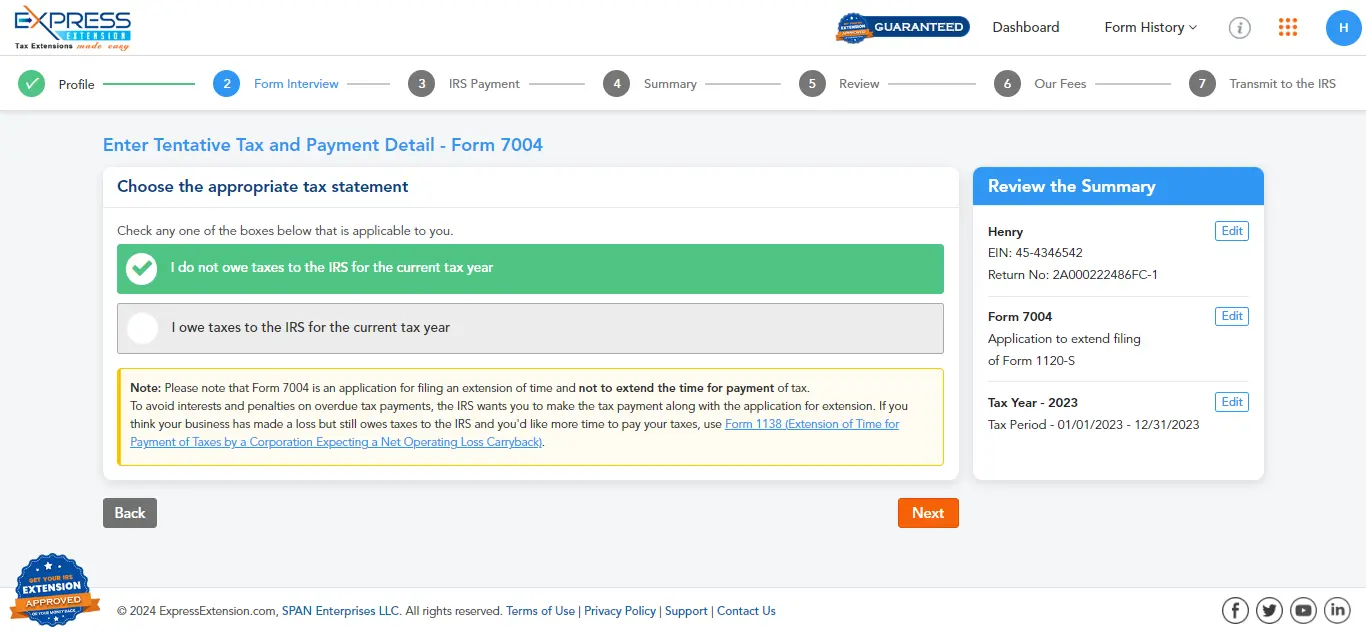

How to E-file Form 7004 Extension Online?

Follow these Steps to File Form 7004 online in less than 5 Minutes

-

File Form 7004 Quickly—No Questions Asked!

Filing a Form 7004 extension is simple! Just enter your business information and any tax due details—no questions asked.

-

E-File & Get Instant Approval

Review your form summary and e-file it with the IRS. Receive instant IRS status updates via email or track them through your dashboard.

-

Get a 6-Month Extension & Stay Stress-Free

In most cases, the IRS approves extension requests immediately, granting up to six additional months to file your business tax return.

Ready to E-file Form 7004?

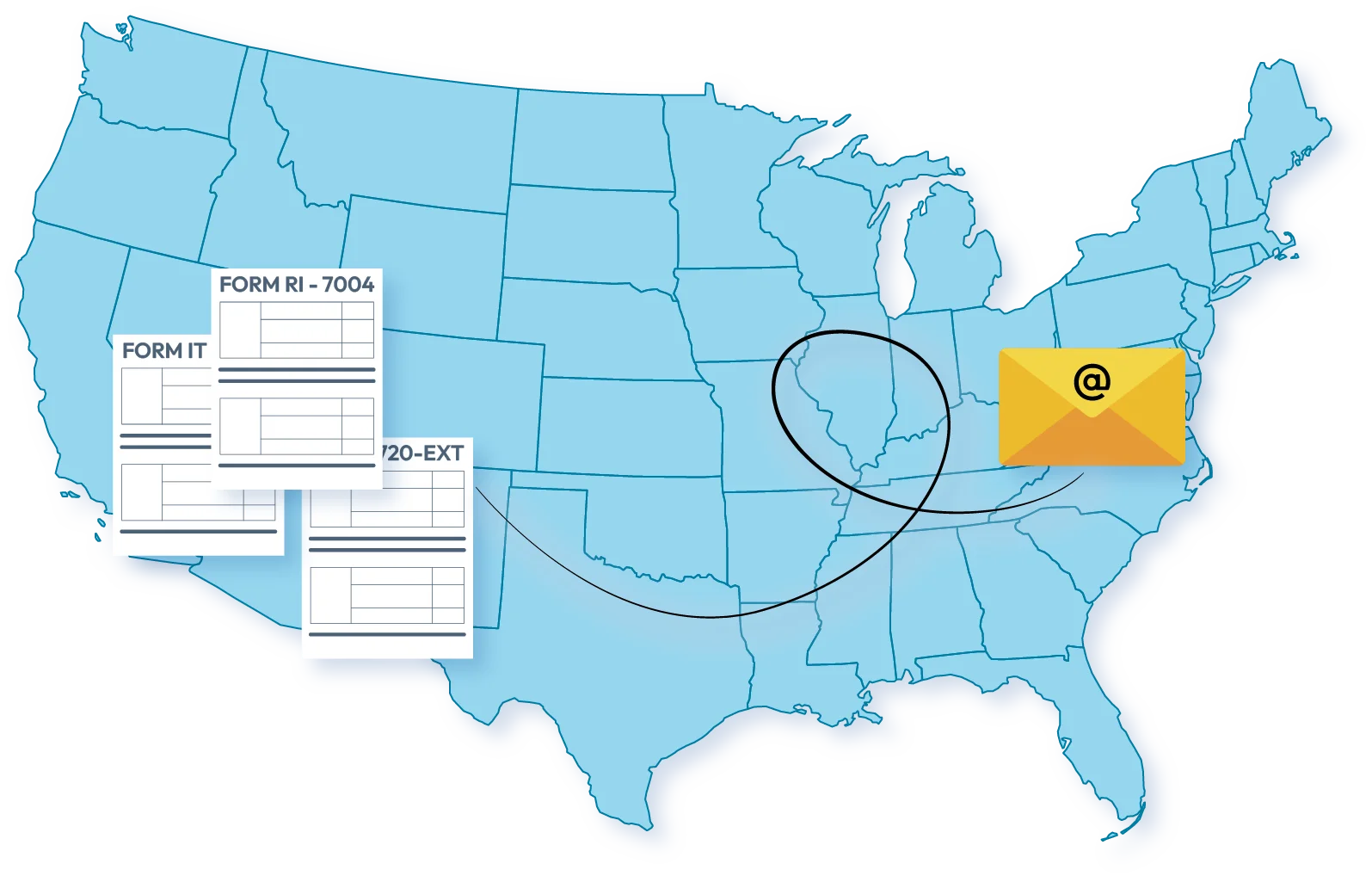

State Extensions for Business Tax Returns

- Certain states require businesses to file a separate extension form.

Learn more about your state tax extensions. - ExpressExtension has a simple process for completing and downloading your state tax extension forms.

Ready to file 7004 with the state?

See why our customers choose us year after year to e-file Form 7004.

Trusted and loved by users like you.

4.8 rating of 12,784 reviews

ExpressExtension - The Smart Choice for Business Owners and Tax Professionals

Form 7004 E-file Pricing

- 3-Simple Step Filing

- Get your Extension approved or Money Back*

- File from any device

- Instant IRS Status Update

- World Class Customer Support

- Retransmit Rejected Returns for FREE

Frequently Asked Questions to File 7004 Online

What is IRS Form 7004?

The IRS Form 7004 is an extension form used by businesses to get an automatic extension of up to 6 months to file certain business income tax, information, and

other returns.

Form 7004 can be used by all types of business entities, including

- C-Corporations (Form 1120)

- S-Corporations (Form 1120S)

- Multi-Member LLCs

- Partnerships (Form 1065)

- Trusts, and Estates ( Form 1041)

When is the deadline to file Form 7004 for S Corporations?

S Corporations are required to file Form 7004 on or before the original deadline of their tax return Form 1120-S, which is by the 15th day of the 3rd month after the taxable year ends.

For S-Corporations following the 2024 calendar tax year, the 7004 deadline is on March 17, 2025.

Learn more about S-corporation tax extension.

When is the deadline to file Form 7004 for C Corporations?

C Corporations are required to file Form 7004 on or before the original deadline of their tax return Form 1120, which is by the 15th day of the 4th month after the taxable year ends.

For C-Corporations following the 2024 calendar tax year, the deadline is on April 15, 2025.

Learn more about Corporate tax extension.

When is the deadline to file Form 7004 for Partnership?

Partnerships are required to file the 7004 form on or before the original deadline of their tax return Form 1065, which is by the 15th day of the 3rd month after the taxable year ends.

For Partnerships following the 2024 calendar tax year, the deadline is on March 17, 2025 .

Learn more about Partnership tax extension.

Can I file an extension for an LLC?

Yes, If you are operating a multi-member LLC, you can apply for an extension using Form 7004 and get an extension of up to 6 months of time to file your business income tax returns.

If you’re a single-member LLC treated as a disregarded entity, you must use 4868 to request an extension.

Learn more about LLC tax extension

How Do I Know the Status of My 7004 Return?

When you e-file your Form 7004 with ExpressExtension, you will receive status updates instantly through your registered email, or you can check your dashboard.

Can I pay my balance tax due while filing Form 7004?

Yes, you can choose the EFW or EFTPS option to pay your balance tax due while filing an extension.

How much does it cost to file Form 7004?

File Form 7004 online for as low as $19.95 with our easy-to-use platform. Enjoy fast processing and secure e-filing at an affordable price. Start filing today!

What is the difference between Form 7004 and Form 4868?

Form 7004 is for businesses, trusts, and estates, while Form 4868 is for individual taxpayers. Click here to learn more.

Ready to e-file your Form 7004?

Request an Extension Now