Federal Extensions for Individual Income Tax Returns

- Updated June 20, 2022 - 8.00, AM Admin, ExpressExtensionEvery year, the IRS requires individual taxpayers to file a personal income tax return to report their income and expense details. This helps the IRS determine whether the individuals owe any taxes or are eligible for a tax refund.

However, if you need more time to prepare and file your income tax return, you have the option to request a tax extension.

Note: You will only be granted an extension if you file on or before the due date.

ExpressExtension created this helpful guide to simplify the process of filing an

IRS Tax Extension.

Table of Contents

1. How to apply for an income tax extension?

2. When is the due date to file an IRS Income tax extension Form 4868?

3. IRS Automatic Tax Extension for U.S. Citizens, Resident Aliens Living Abroad

4. IRS Automatic Tax Extension for the Military Personnel

5. How to apply for an IRS Income Tax Extension?

6. How to complete the IRS Income Tax Extension?

7. How to File a State Income Tax Extension?

8. Why should I Choose ExpressExtension to File an IRS Income Tax Extension?

How to apply for an income tax extension?

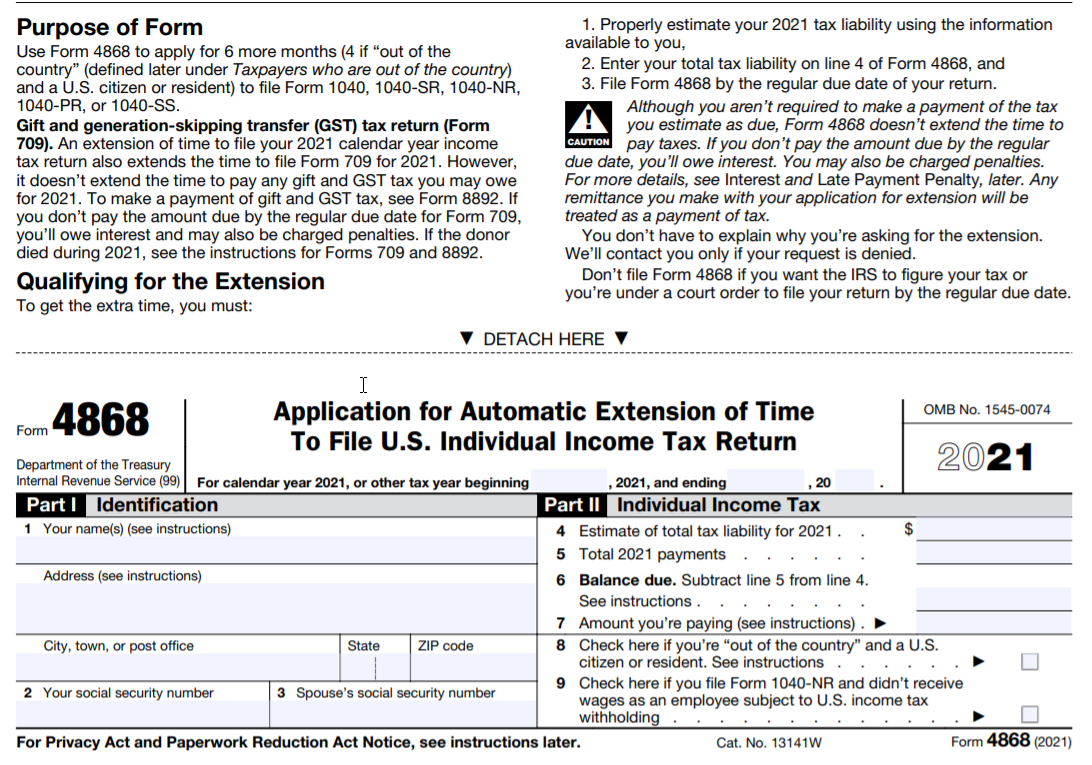

If you need additional time to file your individual income tax return, you can request an additional 6 months of time from the IRS by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

The IRS doesn’t ask for any explanation from the filers to request an extension.

Important reminder:

Form 4868 only extends your time to file. It doesn’t extend your tax

payment due date.

You must make your tax payment before the original deadline.

If you owe taxes after the actual due date, it is subject to interest and a late-payment penalty.

However, a late-payment penalty is not incurred if you’ve paid 90% of your actual tax liability before the regular due date. You can then pay the remaining when you file your tax return.

When is the due date to file an IRS Income tax extension Form 4868?

The IRS income tax extension Form 4868 is due by April 15.

If you file Form 4868, and it is accepted by the IRS, you can extend your income tax return filing deadline until October 15.

If the due date falls on the weekend or national holiday, the due date will be the next business day.

Important reminder:

The IRS will reject your return if you file Form 4868 after the deadline.

IRS Automatic Tax Extension for U.S. Citizens, Resident Aliens

Living Abroad

If you are a U.S. resident or resident alien living outside the US and Puerto Rico on Tax Day and your main place of business is outside of the United States, your tax deadline to file an IRS Tax Extension is generally June 15.

IRS Automatic Tax Extension for the Military Personnel

If you are a member of military or naval service and working outside of the United States and Puerto Rico during the deadline, the IRS provides you the automatic

2-month extension of time to file your Tax Return.

How to file IRS Income Tax Extension?

Individuals can apply for an IRS tax extension by filing Form 4868 electronically

or on paper.

Although, the IRS strongly recommends individuals to file tax extension forms electronically. Choosing to file your form 4868 electronically will help you get the IRS status updates instantly.

If you file a paper copy of the extension form, the IRS will take longer to process your filing, and you won't receive an acknowledgment at the same time.

To check the IRS Mailing address, click here.

How to complete the IRS Income Tax Extension?

To file your personal income tax extension Form 4868 with the IRS, you must complete the following information:

- Personal details such as Full name, Address, & SSN

- If you're filing jointly, you'll need the same information for your spouse

- Total tax liability & payment for the tax year

- Balance due if any

To learn more about Form 4868 Instructions, visit: https://www.expressextension.com/form-4868-instructions/.

How to File a State Income Tax Extension?

Most states request individuals to file income tax returns at the state level.

If you wish to extend the state income tax filing deadline, you can file a state tax extension Form.

The requirements for filing an income tax extension for each state varies.

Some states have the state-specific forms to extend the state income tax returns. Whereas, other states will automatically accept the valid Federal tax extension and do not require a separate state application.

To find your State tax extension filing requirements, please click here.

Why should I Choose ExpressExtenion to File an IRS Income Tax Extension?

ExpressExtension is one of the most trusted IRS authorized e-filing providers for income tax extensions. With over a decade of experience in filing IRS tax extension forms, we help you to complete and e-file your personal income tax extension form 4868 easily with the IRS to get an automatic extension of up to 6 months.

Advantages of e-filing your Individual Income Tax Extension:

- Request an extension in minutes from any device

- Get your 4868 Extension Approved or your money back

- Easy options to pay your balance due to the IRS

If you're a tax professional, ExpressExtension offers a bulk upload feature that lets you upload your clients' income tax extension data in bulk and offers volume-based pricing that can save you time and money.

Are you ready to get started?

Create a free ExpressExtension account today! Our application guides you through the extension filing process for an instant, automatic 6-month IRS extension.

Article Sources:

Helpful Videos

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Recent Queries

- I will be living out of the country. So I cannot file and pay my tax on time. Will I get a penalty from the IRS?

- What type of tax extension should I file if I'm self-employed?

- I do not have an SSN to file form 4868. What should I do?

- [E-File Error Code F4868-002-01] How do I resolve it?

- What payment options do I see while e-filing 4868?

Ready to File Individual Tax Extension Form 4868 Online?

Get Started with ExpressExtension and file your personal tax extension form 4868 in minutes