IRS Form 4868 Mailing Address

Form 4868 is an extension form used by U.S. individual taxpayers to apply and get an extension of up to 6 months to file their personal income tax returns.

Form 4868 can be filed on paper or electronically. However, the IRS encourages you to

E-File 4868 for quicker processing.

If you choose to file a paper copy of IRS Form 4868, this article provides you with the mailing address where the IRS requires you to mail the extension form.

Table of Contents

1. Form 4868 Filing Due Date

Generally, the deadline to file personal tax Form 1040 is April 15, 2024 (April 17, 2024, if you live in Maine or Massachusetts). If you need additional time to file your personal tax return, you must file Form 4868 on or before the original deadline.

When you paper or file form 4868 online, your personal tax deadline will be extended to October 15, 2024, to file your 1040 Tax Return.

2. Form 4868 Mailing Address

The mailing address for sending the paper copy to file personal tax extension may vary depending upon the following factors:

- The location you live in

- Whether or not you’re making a tax payment

Note: The IRS encourages filers to e-file Form 4868 for quicker processing. Switch to E-file Today.

| If you live in | Where to Mail Form 4868 with payment | Where to Mail Form 4868 without payment |

|---|---|---|

| Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas |

Internal Revenue Service,

P.O. Box 1302, Charlotte, NC 28201-1302. |

Department of the Treasury, Internal Revenue Service Center,

Austin, TX 73301-0045. E-File from any Device

E-File Now

Instant IRS Approval

|

| Arizona, New Mexico |

Internal Revenue Service,

P.O. Box 802503, Cincinnati, OH 45280-2503. |

Department of the Treasury, Internal Revenue Service Center,

Austin, TX 73301-0045. E-File from any Device

E-File Now

Instant IRS Approval

|

| Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin |

Internal Revenue Service,

P.O. Box 931300, Louisville, KY 40293-1300. |

Department of the Treasury, Internal Revenue Service Center,

Kansas City, MO 64999-0045. E-File from any Device

E-File Now

Instant IRS Approval

|

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming |

Internal Revenue Service,

P.O. Box 802503, Cincinnati, OH 45280-2503. |

Department of the Treasury, Internal Revenue Service Center,

Ogden, UT 84201-0045. E-File from any Device

E-File Now

Instant IRS Approval

|

| Arkansas, Oklahoma |

Internal Revenue Service,

P.O. Box 931300, Louisville, KY 40293-1300. |

Department of the Treasury, Internal Revenue Service Center,

Austin, TX 73301-0045. E-File from any Device Instant IRS Approval |

| Pennsylvania |

Internal Revenue Service,

P.O. Box 802503, Cincinnati, OH 45280-2503. |

Department of the Treasury, Internal Revenue Service Center,

Kansas City, MO 64999-0045. E-File from any Device Instant IRS Approval |

| A foreign country, American Samoa, or Puerto Rico, or are excluding income under Internal Revenue Code section 933, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien, or nonpermanent resident of Guam or the U.S. Virgin Islands |

Internal Revenue Service,

P.O. Box 1303, Charlotte,NC 28201-1303 |

Department of the Treasury, Internal Revenue Service Center,

Austin, TX 73301-0215. E-File from any Device Instant IRS Approval |

| All foreign estate and trust Form 1040-NR filers | Internal Revenue Service, P.O. Box 1302, Charlotte, NC 28201-1302 USA. |

Department of the Treasury, Internal Revenue Service Center,

Kansas City, MO 64999-0045 USA. E-File from any Device Instant IRS Approval |

| All other Form 1040-NR and 1040-SS filers |

Internal Revenue Service,

P.O. Box 1302, Charlotte, NC 28201-1302 USA. |

Department of the Treasury, Internal Revenue Service Center,

Austin, TX 73301-0045 USA. E-File from any Device Instant IRS Approval |

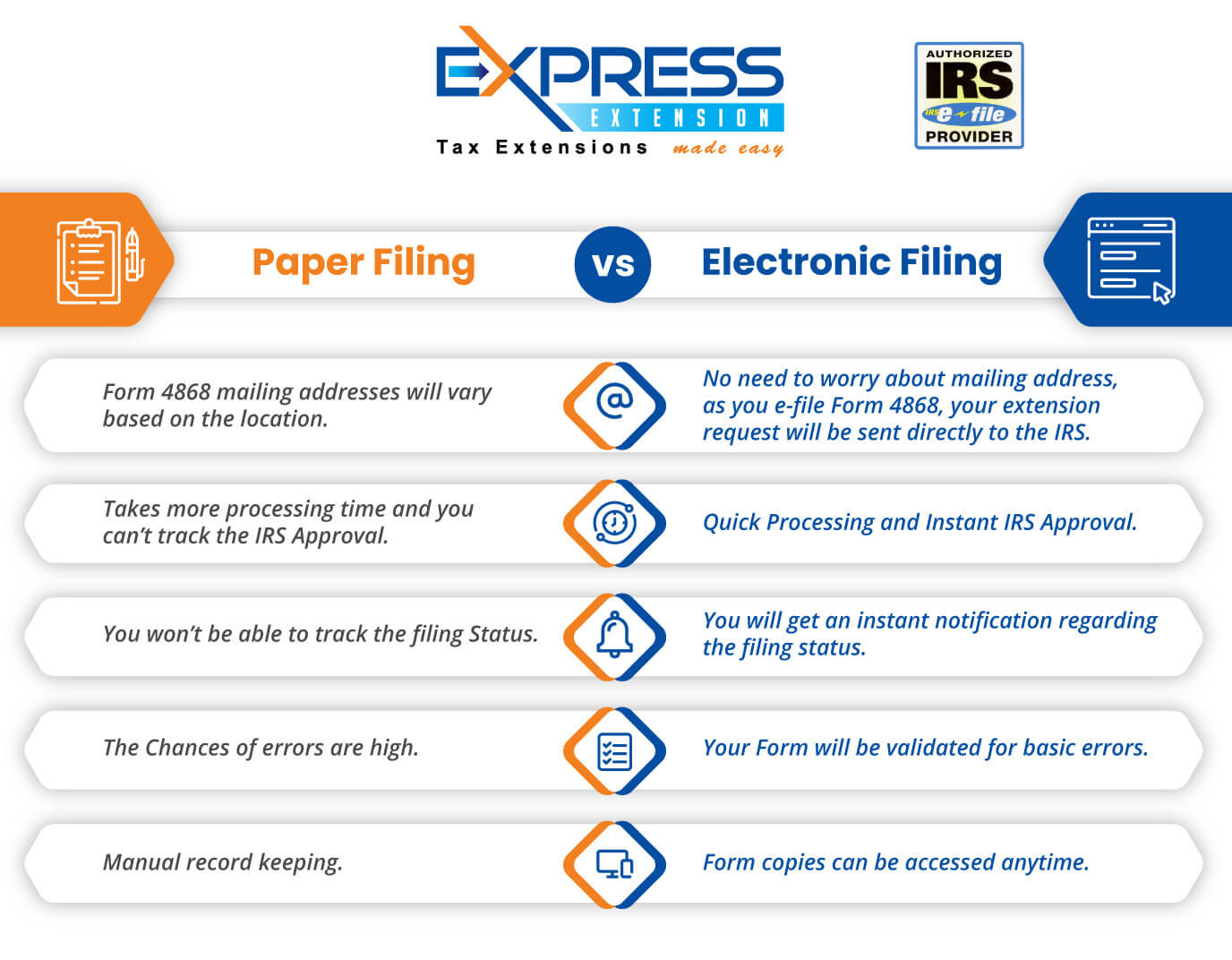

3. Advantages of E-filing Form 4868

If you choose to E-file form 4868 instead of paper filing it to the IRS, you can have a lot of benefits. Some of these benefits include:

- Quicker processing of your personal tax extension

- Receive instant status updates from the IRS

- You can easily track your extension form’s status

- There is no paperwork involved

- If the extension is rejected, you can fix errors and retransmit the form for free.

4. E-file your Form 4868 with ExpressExtension!

Instead of going through all the hassles involved in paper filing 4868 form, you can switch to e-filing with ExpressExtension!

ExpressExtension is an IRS-authorized e-file provider that can simplify your Form 4868 filing with the following helpful features.

- Express Guarantee - Get an automatic refund of your filing fee if the IRS rejects your form as a duplicate filing.

- A hassle-free filing process with step-by-step guidance

- File conveniently from any device

- Internal audit system to ensure accurate returns.

- Bulk-upload templates and volume-based pricing options.

- Options to pay your tax due.

- Instant IRS status notifications regarding your extensions

- Retransmit rejected returns for free

How do I File Form 4868 Electronically with ExpressExtension?

With ExpressExtension, you can complete and E-file form 4868 in minutes. Just follow the steps below to file Form 4868:

- Create a free ExpressExtension account

- Choose Form 4868

- Enter your personal details

- Enter tentative tax details, if any

- Review the Form Summary and Transmit it to the IRS

Helpful Videos

Recent Queries

- How do I e-file Form 4868 with ExpressExtension

- What if I am an “Out-of-the-Country” tax filer filing

Form 4868? - I do not have an SSN to file Form 4868. What

should I do? - What payment options do I see while e-filing

Form 4868? - My personal tax extension was approved by the IRS. What is my extended tax return due date?

Ready to File Individual Tax Extension Form 4868 Online?

Get Started with ExpressExtension and file your personal tax extension form 4868 in minutes