How to File Business Tax Extension Online for Tax Year 2023?

Select Extension Form 7004 & Enter Details

Enter Estimated Tax Payments, if Applicable

Transmit your Form 7004 to the IRS

Begin filing your Business’s Tax Extension Today, from any device!

Information Required for Filing Business Tax Extensions

In order to complete your business tax extension, you will need to have the following information available:

- Basic Business Details such as Name, EIN, and Address

-

Type of Business Structure

- S-Corporation

- C-Corporation

- Partnership

- LLC as a Corporation

- LLC as a Partnership

- Trust, Estates, and Others

- Type of the tax form for which you need an extension (for example: 1120, 1120-S, 1065, 1041, etc)

- Organization Accounting Period (Calendar or Fiscal Tax Year)

- Estimated tax dues, if any.

For more details regarding the business structure, visit here.

Note: Make sure your information matches what the IRS has on record. You can verify your information with the IRS by calling 1-800-829-4933.

How to file Business Tax Extension Form 7004 Online

for 2021 tax year?

Enter Business Details

Choose Business Type & Form

Enter Tentative Tax Payment Details

Review your Form

Transmit your Form 7004 to the IRS

Get Started Today and File from any Device!

a class="primary_btn font15" href="https://secure.expressextension.com/User/AccountSignUp/?ref=form7004extension">Request an Extension Now State Extensions for Business

Tax Returns

- Certain states require businesses to file a separate extension form.

Learn more about your state tax extensions. - ExpressExtension has a simple process for completing and downloading your state tax extension forms.

Ready to Complete your State

Tax Extension?

Get Started Now

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Frequently asked questions about Business

Tax Extensions

How do I get an extension for my business income tax?

Businesses can file Form 7004 and get an automatic extension of up to 6 months to file their business income tax returns. The extended deadline will vary based on the business type and the tax year.

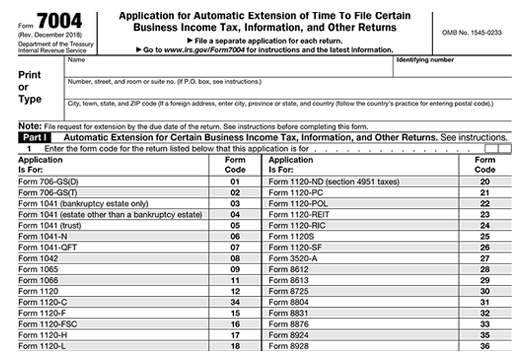

What are the Forms whose deadlines can be extended using Form 7004?

Form 7004 can be filed with the IRS to extend 33 business tax forms.

Here is the list of business tax Forms whose filing deadline can be extended using

Form 7004.

- Form 706-GS(D)

- Form 706-GS(T)

- Form 1041 (bankruptcy estate only)

- Form 1041 (estate other than a bankruptcy estate)

- Form 1041 (trust)

- Form 1041-N

- Form 1041-QFT

- Form 1042

- Form 1065

- Form 1066

- Form 1120

- Form 1120-C

- Form 1120-F

- Form 1120-FSC

- Form 1120-H

- Form 1120-L

- Form 1120-ND

- Form 1120-ND (section 4951 taxes)

- Form 1120-PC

- Form 1120-POL

- Form 1120-REIT

- Form 1120-RIC

- Form 1120S

- Form 1120-SF

- Form 3520-A

- Form 8612

- Form 8613

- Form 8725

- Form 8804

- Form 8831

- Form 8876

- Form 8924

- Form 8928

When is the deadline to file an extension for business income tax returns?

The deadline to file business tax extension Form 7004 is based on the type of tax return, what form you need to extend, the business type, and it’s fiscal tax year.

For businesses following the calendar tax year,

- For certain tax returns such as Form 1120-S, 1065, etc., the deadline is March 15, 2024.

- For certain tax returns such as Form 1120, 1041, etc., the deadline is April 15, 2024.

Is your business operating on a fiscal tax year? Find your due date.

What is the Form 7004 perfection period?

When your return is denied, the IRS will provide you a grace period to fix any problems. The Form 7004 has a 5-day grace period from the date of rejection. To avoid penalties, you must make the necessary corrections to your return within this time frame.

How to file Business Tax Extension Form 7004?

The IRS Form 7004 can be filed on paper or electronically. However, the IRS recommends the e-filing of forms for quicker processing.

Note: Form 7004 must be paper-filed to request extensions for Forms 8612, 8613,

8725, 8831, 8876, or

706-GS(D).

Does the extension also apply to tax payments?

No! The business tax extension Form 7004 will only extend the deadline for filing business tax returns, the tax payments must be paid by the original deadline.

Does Form 7004 extend the deadline to file business tax returns with the State?

Some states accept an approved federal Form 7004 as an extension of time to file business tax returns at the State level. However, some states require businesses to file separate state forms to obtain a business

tax extension.

Ready to File your Business Tax Extension?

Get Started NowHelpful Resources for Business Tax Extensions

Helpful Videos about Business Tax Extensions

Recent Queries

Need More Assistance?

Our team is here to help you via live chat, phone, and email. You can also check out our Knowledge Base for FAQs and helpful articles.

Ready to File a Tax Extension for

your Business?

Get Started with ExpressExtension & file your form in minutes